will capital gains tax increase in 2021

Capital Gains Tax Rate. Apr 23 2021 305 AM.

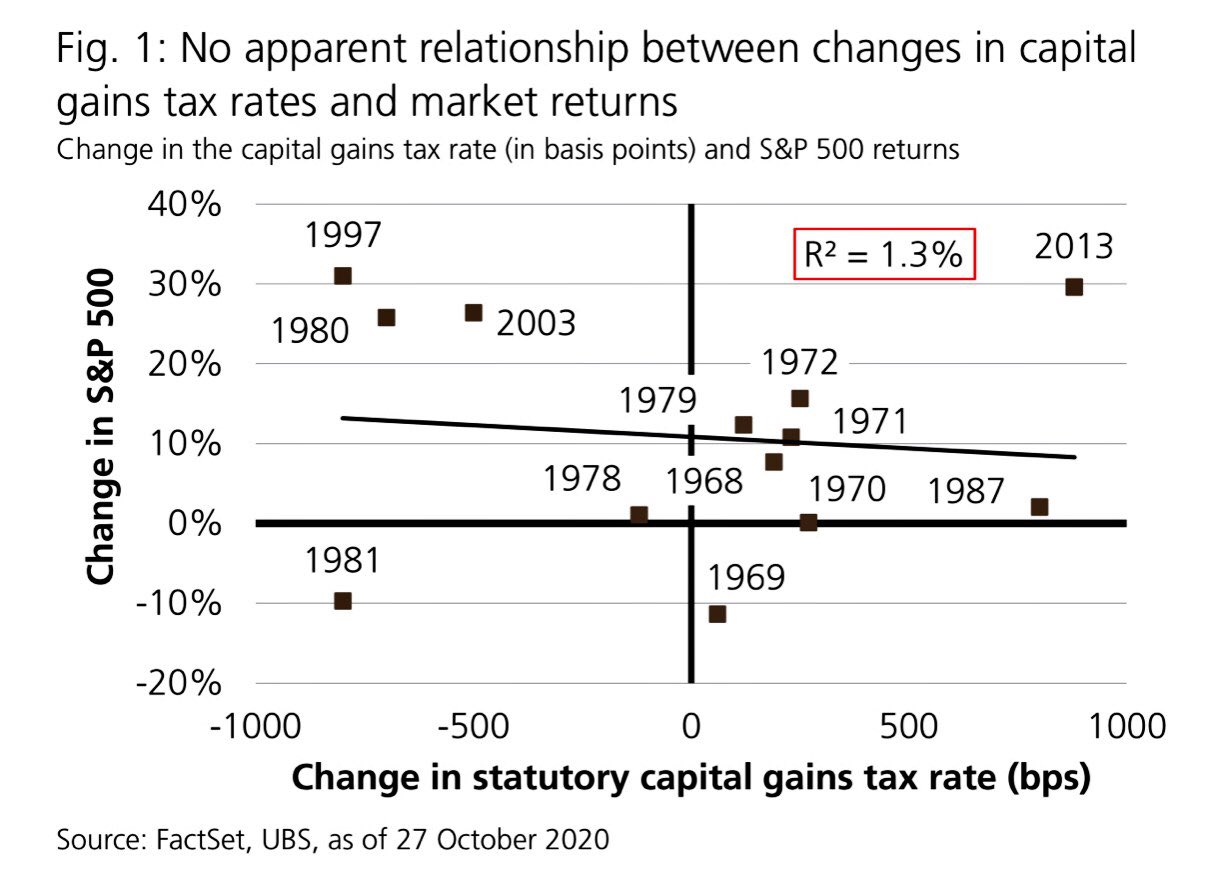

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. The effective date for this increase would be September 13 2021.

2021 capital gains tax calculator. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

Many speculate that he will increase the rates of capital. This is the second time the proposed increase has been made after. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

There are seven federal income tax rates in 2023. Thats a 900 increase from the 12950 standard deduction for the upcoming tax season. 2021 Longer-Term Capital Gains Tax Rate Income Thresholds.

Currently the top capital gain tax rate is 238 percent for gains realized on. 2022 capital gains tax rates. However it was struck down in March 2022.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Note that short-term capital gains taxes are even higher. To address wealth inequality and to improve functioning of our tax.

Posted on January 7 2021 by Michael Smart. For married couples filing jointly the payout climbs to 27700 for the 2023 tax year. Implications for business owners.

The Chancellor will announce the next Budget on 3 March 2021. Your 2021 Tax Bracket To See Whats Been Adjusted. For long-term capital gains thats a potential increase of up to 196 over the current.

Its time to increase taxes on capital gains. What If Bidens Capital Gains Tax Is Retroactive. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

A Retroactive Capital Gains Tax Increase. 1 day agoCapital Gains Tax is charged on gains accrued from the transfer of property buildings land or shares in Kenya. The lifetime capital gains exemption is 892218 in.

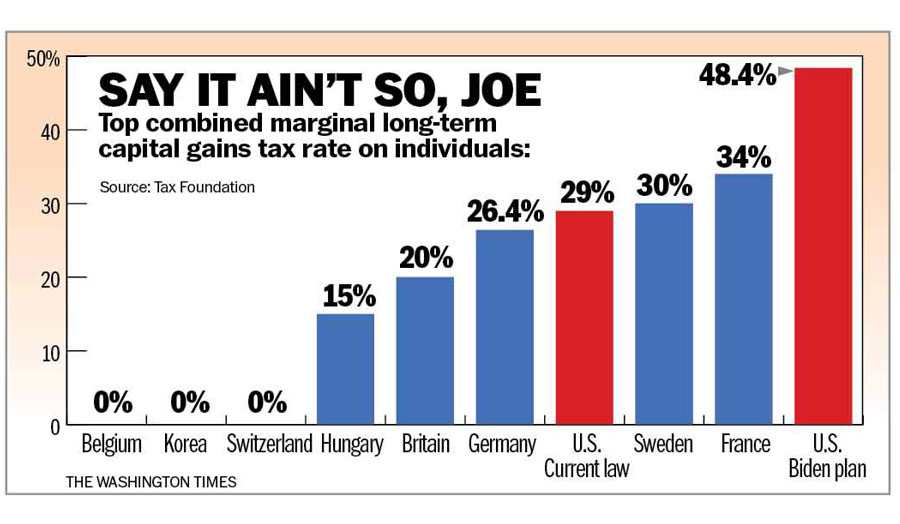

Capital gains tax is likely to rise to near 28 rather. Weve got all the 2021 and 2022 capital gains. The proposal would increase the maximum stated capital gain rate from 20 to 25.

2020 2021 Capital Gains Tax Rates And How To Calculate Your Bill

2022 Income Tax Brackets And The New Ideal Income

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

Inflation Coupled With Democrats Proposed Tax Increases Are A Recipe For Disaster Washington Times

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Are Capital Gains Taxed Tax Policy Center

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

Zeminler Takim Elbise Grua Current Long Term Capital Gains Tax Rate Bluebrook Org

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)